The rise of mobile check deposit fraud has become an escalating concern for financial institutions, challenging them to rethink the way they manage these services. With the increase in fraudulent activities, banks like Fidelity Investments have been compelled to implement stricter policies to mitigate the risks. However, these measures, while essential for bolstering security, pose significant challenges for consumers who have come to rely on the convenience and immediacy of mobile deposits. This article scrutinizes the delicate balance that banks must strike between ensuring security and maintaining the ease of use that customers expect from mobile deposit services.

The Growing Threat of Mobile Check Deposit Fraud

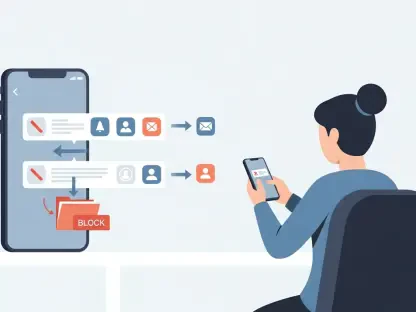

Mobile check deposit fraud has significantly impacted the financial industry, compelling institutions to reassess their operational protocols. Fraudsters have honed sophisticated methods to exploit mobile deposit systems, often leveraging social media to lure naive individuals into compromising their banking credentials under the guise of easy financial gains. Once they have access, these criminals deposit falsified checks and expeditiously withdraw the funds before any verification steps, leaving the legitimate account holders to deal with the fallout of the fraudulent activities.

Fidelity Investments has been one of the many institutions experiencing the brunt of this increasing phenomenon. The company’s response has been to slash the upper limit of mobile check deposits from an ambitious $100,000 down to a more restrained $1,000. Moreover, the timeframe within which deposited funds become available has been significantly extended, sometimes lasting up to 16 business days instead of the conventional period of two to six days. These rigorous measures are designed to thwart fraudulent activities but simultaneously affect users who depend on swift fund accessibility for day-to-day financial operations.

Fidelity’s Response to Fraud

Fidelity’s strategic decision to constrain mobile check deposits and delay accessibility of funds embodies a larger movement among financial institutions seeking to reduce vulnerability to fraud. By tempering the deposit limit to $1,000, Fidelity aims to cap potential losses should fraud occur. The delay in fund availability grants additional time for a comprehensive verification process, thus diminishing the chances of fraudsters successfully accessing the funds before the checks are officially cleared.

While these adjustments are paramount for security, the consumer implications are substantial. Many customers depend on the efficiency and immediacy of mobile deposits to manage their financial needs. The newly imposed policies necessitate longer wait times and impose lower deposit thresholds, thereby potentially disrupting users’ financial routines. Nevertheless, such constraints are indispensable for fostering an environment that offers enhanced protection for both the institution and its patrons against fraudulent schemes.

Similar Cases and Industry-Wide Responses

Fidelity isn’t isolated in its experience with mobile check deposit fraud; other financial institutions, including Chase Bank, have encountered similar challenges. A prominent case known as the “Chase Bank Money Glitch” evidenced fraudsters depositing counterfeit checks to exploit the bank’s mobile deposit platform. In retaliation, Chase undertook legal proceedings against individuals who manipulated this glitch, which underscores the severity of repercussions for engaging in such fraudulent activities.

The broader incidence of mobile check deposit fraud has impelled various banks to adopt restrained and conservative methodologies. These typically involve minimizing deposit amounts and elongating fund availability durations akin to Fidelity’s countermeasures. While these systematic changes aim to fend off fraudulent actions, they invariably render mobile deposits less convenient for customers who have grown accustomed to its rapid functionalities. Yet, such steps are appraised as critical to counteract the tide of forgery and deceit impacting the financial sector.

Consequences for Consumers

The repercussions of these institutional shifts are acutely felt by consumers. Account holders victimized by fraud often endure significant aftermath, as their personally identifiable information is inextricably linked to the fraudulent accounts. The Federal Bureau of Investigation (FBI) terms such unsuspecting individuals as “money mules,” since they are exploited into participating in unlawful operations under false pretenses of shared profit.

To safeguard against such risks, consumers are advised against ever divulging their banking login credentials. Any financial proposal that appears disproportionately lucrative is apt to entail consequential legal and monetary jeopardies. Remaining vigilant and informed about these potential threats can significantly diminish an individual’s likelihood of falling prey to mobile check deposit fraud, thereby fostering a safer banking environment and personal financial security.

The Future of Mobile Deposits

The surge in mobile check deposit fraud has become a growing concern for financial institutions, pushing them to reassess how they manage these services. With fraudulent activities on the rise, banks like Fidelity Investments have found it necessary to enforce stricter policies to mitigate risks. Yet, these measures, while crucial for enhancing security, create notable challenges for consumers who have become accustomed to the convenience and speed of mobile deposits. This article examines the delicate balance that banks must maintain between ensuring robust security and providing the ease of use that customers expect from mobile deposit services.

Managing this balance involves several factors. Financial institutions need to adopt advanced technologies to detect and prevent fraud without creating additional hurdles for users. Furthermore, educating customers about best practices and potential risks is indispensable. Banks must also stay ahead of evolving fraud tactics, which requires continuous monitoring and adaptation. Ultimately, the goal is to protect both the institution and its customers from fraud while preserving the seamless experience that mobile deposits offer.