Digital banking has revolutionized the way financial transactions are conducted in India. The convenience and speed of online banking have drawn millions of users into the digital fold. However, this rapid transition has also opened the door to increasing cyber threats. Understanding the dynamics and implementing robust security measures is essential to protect users from these evolving risks. With the rise of digital platforms, the financial sector finds itself at a crossroads where technological advancement meets serious security concerns. The incredible convenience offered by online banking comes with the equally significant challenge of managing cyber threats that have evolved in both number and sophistication.

Surge in Cybercrime: A Growing Concern

The digital banking ecosystem in India is currently facing a significant challenge: cybercrime. In 2023 alone, there were 1.13 million reported cases of financial cyber fraud, resulting in immense financial losses and reputational damage. This alarming statistic underscores the vulnerabilities inherent in the digital banking space. With transactions increasingly moving online, cybercriminals are becoming more sophisticated, employing advanced techniques to exploit weaknesses within both the system and its users. These incidents have led financial institutions to grapple with massive financial losses, raising the need for a comprehensive approach to digital banking security that involves multiple stakeholders.

The increasing number of cyber threats necessitates a more proactive and layered approach to digital banking security. Cybercriminals constantly adapt to new security measures, making it a game of cat and mouse between them and the institutions they target. Financial institutions are left with no option but to keep pace with these evolving threats, often requiring them to allocate significant resources to cybersecurity initiatives. Not only do these breaches result in financial setbacks, but they also tarnish the reputation of institutions, causing long-term impacts on customer trust and loyalty. Therefore, a comprehensive strategy involving technology, education, and a robust regulatory framework is essential for mitigating these risks.

The Role of Consumer Behavior in Cybersecurity

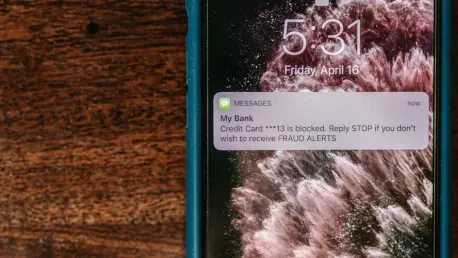

While consumers are enthusiastic about embracing digital financial products, they often overlook basic cyber hygiene, thereby making themselves prime targets for cybercriminals. In their eagerness to adopt new technologies, consumers frequently neglect essential security practices such as creating strong passwords, avoiding public Wi-Fi for financial transactions, and recognizing phishing attempts. This neglect makes them easy prey for cybercriminals who capitalize on emotions like greed and fear. For example, phishing attacks and social engineering tactics frequently exploit human vulnerabilities to gain unauthorized access to sensitive information. Educational campaigns and regular reminders about best practices in cyber hygiene are essential in this context.

Users must be vigilant about not sharing personal information, maintaining strong and unique passwords, and being skeptical of unsolicited communication. Effective cybersecurity isn’t just the responsibility of financial institutions; end-users play a critical role as well. Simple actions like verifying the authenticity of a contact or regularly updating security settings on devices can make a significant difference. In this interconnected digital landscape, both individual and collective vigilance are crucial for minimizing cyber risks. Concerted efforts from all stakeholders, including government bodies, financial institutions, and tech companies, can create a safer digital banking environment.

Unified Payment Interface (UPI) and Its Implications

Since its inception, the Unified Payment Interface (UPI) has seen exponential growth in India. From a modest 418 million transactions in 2016, UPI transactions surged to an astonishing 117 billion in 2023. This boom was significantly influenced by the government’s demonetization policy in 2016, which spurred a shift from cash transactions to digital payments. The rapid adoption of UPI, while beneficial for financial inclusion, has also expanded the attack surface for cybercriminals. The ease of conducting transactions through UPI means that even minor lapses in security can lead to substantial financial risks. For all its benefits, UPI also introduces new challenges in securing vast networks of digital transactions.

Banks and payment service providers have had to implement stringent security measures to keep up with the rising number of transactions and the accompanying risks. However, the system’s inherent vulnerabilities cannot be overlooked. Despite multiple layers of security, any breach can have far-reaching consequences due to the sheer volume of transactions processed daily. The challenge amplifies as more users adopt the platform, increasing the probability of encountering fraudulent activities. Therefore, continuous monitoring, regular updates to security protocols, and consumer education are crucial for maintaining the integrity of digital payment systems like UPI.

Technological Advancements Versus Cyber Risks

The proliferation of smartphones and affordable internet access has revolutionized digital banking, enabling millions to perform financial transactions with unprecedented ease. However, it has also created new opportunities for cyber threats, where cybercriminals are leveraging sophisticated tools and methods to exploit these technological advancements. The growing dependency on digital platforms has consequently expanded the attack surface, making it imperative for financial institutions to stay ahead of cyber threats. To remain vigilant and resilient, they must continually invest in cutting-edge technologies such as advanced encryption methods, real-time transaction monitoring, and artificial intelligence to detect unusual patterns and potential fraud.

These technological measures, while effective, are only part of the solution. Cybercriminals adapt quickly, often finding new ways to bypass even the most advanced security systems. This ongoing arms race between cybersecurity defenses and cyber threats means that organizations must be ever-vigilant, constantly updating and refining their security protocols. Moreover, integrating advanced technologies into existing systems presents its own set of challenges, requiring significant investments in both infrastructure and training. As such, a holistic approach that combines technology with user education and regulatory oversight is essential for creating a secure digital banking environment.

Multi-Stakeholder Responsibility in Cybersecurity

Ensuring the security of digital financial transactions is not the sole responsibility of any one party. Consumers, financial institutions, technology providers, and regulators all play critical roles in maintaining a secure environment. Regulatory bodies like the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) have issued guidelines to enforce digital security, underscoring the importance of a coordinated effort. However, despite the stringent regulations and technological safeguards, consumer behavior often remains the weakest link in the security chain. This multifaceted approach requires continuous collaboration and communication among all stakeholders to address the evolving cyber threat landscape effectively.

The role of consumers cannot be overstated, as their actions directly impact the overall security posture of the digital banking ecosystem. Simple acts like enabling two-factor authentication, regularly updating passwords, and being cautious of unsolicited communication can significantly reduce the risk of cyberattacks. Financial institutions and technology providers, on the other hand, must ensure that their platforms are secure by design and resilient against potential threats. Regularly updated security protocols, along with ongoing monitoring and threat detection, are essential for maintaining system integrity. In this interconnected digital world, the collective effort of all stakeholders is crucial for safeguarding the financial sector against cyber threats.

OneSpan’s Comprehensive Security Measures

Technology firm OneSpan has developed a suite of holistic security solutions aimed at securing digital banking transactions. Their focus areas include device, user, and application security, addressing multiple facets of the digital transaction ecosystem. Tools such as App Shielding and CRONTO technology are designed to counteract common cyber threats, providing a robust line of defense. App Shielding, for instance, deactivates banking applications if screen-sharing apps are detected, thereby preventing unauthorized access. Meanwhile, CRONTO technology utilizes encrypted color QR codes for secure authentication, adding an additional layer of security against unauthorized access and data breaches.

These innovations represent a significant leap forward in cybersecurity, but they are not a panacea. Even the most advanced security measures can be compromised if users fail to adhere to basic cyber hygiene practices. Therefore, OneSpan’s approach includes educating users about the importance of security and how to implement best practices. By combining cutting-edge technology with user education, OneSpan aims to create a more secure digital banking environment. This dual focus ensures that security measures are both effective and user-friendly, encouraging widespread adoption and adherence to best practices.

Advanced Authentication Solutions

Among OneSpan’s security offerings are advanced authentication mechanisms designed to thwart sophisticated cyber-attacks, providing an added layer of protection. These include hardware-based solutions and Intelligent Adaptive Authentication, which offer dynamic and personalized security measures based on user behavior. Such systems are invaluable in preventing phishing attacks and man-in-the-middle scenarios, where attackers intercept communications between users and institutions. By analyzing real-time data and user interactions, these technologies can identify anomalies and trigger additional security protocols, ensuring enhanced protection. This proactive approach enables financial institutions to stay ahead of potential threats, providing a secure environment for digital transactions.

These advanced authentication solutions are crucial for maintaining the integrity of digital banking systems, where the stakes are high, and the margins for error are slim. The integration of real-time behavioral analysis and adaptive security measures ensures that even sophisticated attacks can be detected and mitigated. This level of security is essential in an era where cyber threats are constantly evolving, and traditional security measures are often insufficient. By employing cutting-edge technologies and continuously adapting to emerging threats, OneSpan provides a robust framework for securing digital financial transactions.

The Critical Role of End User Practices

Digital banking has transformed how financial transactions are carried out in India, offering unparalleled convenience and speed. Millions of users have quickly adopted online banking for its ease of use. However, this swift shift has also brought an increase in cyber threats. Understanding the dynamics of these threats and implementing strong security measures is crucial to safeguarding users from the growing risks.

As digital platforms become more prevalent, the financial sector faces a critical juncture where technological progress intersects with serious security concerns. While online banking offers incredible convenience, it also presents the significant challenge of managing cyber threats that have not only multiplied but have also become more sophisticated.

The rise of these threats makes it essential for banks and financial institutions to stay ahead of potential cyber-attacks. This includes employing advanced encryption technologies, regularly updating security protocols, and educating users on safe online practices. Only through these measures can digital banking remain a secure and trusted medium for financial transactions.

In summary, the evolution of digital banking in India brings both unparalleled opportunities and considerable risks. As technology continues to advance, it is imperative for the financial sector to prioritize robust security measures to protect users and maintain trust in the digital banking ecosystem.