The transition to cashless transactions in Europe is gaining momentum, with Cyprus and Greece leading the way. This shift is facilitated by significant technological advancements and a notable change in consumer behavior, particularly accelerated by the COVID-19 pandemic. As cashless payments become increasingly prevalent, the focus is on understanding the technological enablers and the broader implications for society.

The Rise of Cashless Transactions in Europe

Increasing Adoption Rates in Cyprus and Greece

In recent years, the adoption of cashless transactions has surged in Europe, with Cyprus and Greece experiencing a particularly rapid shift. A European Central Bank (ECB) survey shows that 70% of consumers in these countries now prefer card payments over cash. This significant change in consumer behavior has been largely driven by the desire for more convenient and safer payment methods, especially amid the COVID-19 pandemic. The pandemic has played a crucial role in this acceleration. Social distancing measures and concerns about virus transmission through physical currency have led many consumers to favor contactless payments. Retailers, too, have adapted by increasingly accepting digital payments, thereby reinforcing the trend.

This phenomenon in Cyprus and Greece mirrors a broader European shift towards cashless payment systems. The integration of digital payment methods into everyday life has become not just a convenience, but a necessity, propelling European nations towards a future where cash transactions might become obsolete. The trend also reflects heightened consumer trust in digital payment platforms, largely due to the seamlessness and security features these technologies offer. Meanwhile, the regulatory environment has increasingly supported this shift by enacting measures that facilitate the use and integration of digital payments across various sectors.

Technological Innovations Driving the Shift

The widespread adoption of cashless transactions is underpinned by several technological advancements. Real-time payment systems, which enable instant money transfers via digital applications, have revolutionized how transactions are conducted. Additionally, Near Field Communication (NFC) technology allows users to make payments simply by bringing their card or mobile device close to a point-of-sale (POS) terminal, making transactions quicker and more efficient. Moreover, the proliferation of mobile payment solutions like Apple Pay and Google Pay has provided consumers with highly intuitive and user-friendly methods to manage their finances. These digital wallets not only streamline the payment process but also offer the convenience of storing multiple cards in one place.

These technologies serve not just as payment facilitators but as vital components in a broader ecosystem of financial services. For example, NFC functionality has been integrated into various devices, extending from smartphones to smartwatches, thereby increasing the avenues through which payments can be made. Furthermore, the advancement of Blockchain technology promises to bring additional layers of security and transparency to these transactions, which is crucial in the fight against financial fraud. With the continual evolution of tech-driven payment systems, we will likely see more innovative solutions emerge, further embedding cashless transactions in everyday commercial activities.

Enhanced Security and Improved User Experience

The Role of Biometric Identification

One of the main advantages of digital transactions is the enhanced security they offer. Mobile devices equipped with biometric identification technologies, such as fingerprint scanning and facial recognition, add an extra layer of security. This removes the need for remembering PIN codes or passwords, making the payment process both secure and straightforward. Biometric identification has been particularly effective in preventing fraud and ensuring that transactions are carried out by authorized users. This advancement has boosted consumer confidence in digital payment methods, contributing to their growing popularity.

The role of biometric technology extends beyond simple identification to offer a secure, multifactor authentication system. This tech can be seamlessly integrated into various points of sale and online platforms, ensuring that transactions are genuinely secure. On top of enhancing user convenience by reducing the steps needed to complete a payment, biometrics also work to deter fraudulent activities that have been prevalent with traditional card payment systems. Digital payments hence become not only faster and more convenient but robust in their resistance to scams and identity theft, increasing their adoption rates across the board.

Convenience Through Digital Wallets

Digital wallets have become a cornerstone of the cashless revolution by offering unparalleled convenience. Solutions like Apple Pay, Google Pay, and others allow consumers to store multiple credit and debit cards securely on their mobile devices. This centralization of financial information simplifies monetary management and facilitates a seamless payment experience. Furthermore, digital wallets often provide additional features, such as tracking spending patterns and offering personalized financial advice. These functionalities not only enhance the user experience but also encourage responsible financial behavior.

In addition to their inherent convenience, digital wallets provide an interconnected ecosystem that promotes user engagement and loyalty. They integrate smoothly with various forms of e-commerce and m-commerce platforms, offering benefits like loyalty points, cashback, and reward systems that appeal to a broad audience. Such features make them stand out as more than just payment tools but as comprehensive financial management systems. Retailers, too, benefit from faster transaction speeds and reduced issues related to cash handling, streamlining operations and improving turnover rates. This synergy between user convenience and business efficiency ensures that digital wallets play a pivotal role in the ongoing shift towards cashless transactions.

Artificial Intelligence and Personalized Services

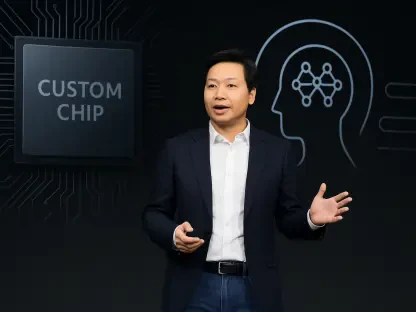

AI’s Impact on Financial Management

Artificial Intelligence (AI) is playing an increasingly prominent role in the realm of cashless transactions. By leveraging vast amounts of data, AI systems can offer personalized financial services tailored to individual consumer needs. These services include spending insights, budgeting tips, and even credit score monitoring. The ability of AI to analyze transaction data and predict consumer behavior enables financial institutions to provide more targeted and effective services. This not only enhances customer satisfaction but also fosters greater adoption of digital payment solutions.

AI’s impact extends to the backend processes of financial management as well. By automating tasks such as risk assessment, fraud detection, and compliance monitoring, AI systems can streamline operations and reduce overhead costs for financial institutions. Algorithms can analyze massive datasets far quicker and more accurately than any human, enabling quick adaptation to market changes and consumer needs. As a result, companies can focus on developing innovative services and solutions tailored to the requirements of their consumer base. Driven by both efficiency and effectiveness, AI also underscores the importance of data integrity and ethical management, ensuring a secure and trustworthy financial environment.

Personalized Customer Experiences

AI’s contribution to personalized customer experiences extends beyond financial advice. Chatbots and virtual assistants powered by AI can offer real-time support to consumers, addressing queries and resolving issues swiftly. This level of responsiveness and customization further elevates the appeal of cashless transactions. Additionally, AI-driven fraud detection systems are becoming increasingly sophisticated. These systems can identify suspicious activity in real-time, minimizing the risk of fraud and ensuring that digital transactions remain secure.

Personalization through AI also means that users receive recommendations and services that fit exactly into their financial habits and goals. From customized savings plans to investment advice, such tailored services foster a deeper connection between consumers and their financial platforms. This higher engagement and trust help to strengthen the overall digital payment ecosystem. Firms are not only able to retain users but also grow their customer bases through positive word-of-mouth and increased satisfaction levels. Additionally, personalized customer experiences create an environment where technological adoption feels natural and indeed beneficial, encouraging the transition to a more digitally focused economy.

The Impending Introduction of the Digital Euro

A Significant Milestone

The anticipated launch of the digital euro represents a pivotal moment in the journey toward a cashless society. The digital euro aims to provide a secure and efficient digital currency option issued by the European Central Bank, with the potential to revolutionize the financial landscape. This initiative is expected to enhance financial transparency and reduce instances of fraud by leveraging blockchain technology. The digital euro will also aim to provide a standardized digital payment method across the Eurozone, facilitating smoother cross-border transactions.

The creation of a digital euro also signals a major leap in how central banks interact with cryptocurrency. Unlike decentralized cryptocurrencies like Bitcoin, a digital euro would offer stability and the backing of a reputable central institution, making it more reliable for everyday transactions and large-scale business operations. The transparency offered by blockchain not only ensures the integrity of each transaction but also builds trust in the system’s accountability. Another major advantage would be the reduction of costs associated with printing and maintaining physical currency, potentially leading to economic benefits on a macro level.

Broader Implications for Society

The trend towards cashless transactions is rapidly gaining traction across Europe, with Cyprus and Greece at the forefront of this movement. This remarkable shift is powered by substantial technological innovations and a significant evolution in consumer behavior, which has been strongly influenced by the COVID-19 pandemic. Consumers have increasingly leaned towards digital payment methods, finding them more convenient and safer amidst health concerns. Contactless payments, mobile banking apps, and other digital financial services have seen a surge in adoption. As a result, cashless payments are becoming commonplace, raising questions about the technological foundations and wider societal implications of this trend.

Innovations like blockchain, mobile payment solutions, and enhanced cybersecurity measures play crucial roles in facilitating this transformation. The implications extend beyond mere convenience; they touch upon economic inclusivity, privacy concerns, and even the role of financial institutions in an increasingly digital world. As Europe continues to embrace these changes, understanding both the technological enablers and societal repercussions is essential for navigating this pivotal shift.